Welcome back from the weekend. The market has been battered all year — but the beatings may continue.

Let's break it down.

If this was forwarded to you, sign up here. Download Insider's app here.

1. Markets haven't yet seen capitulation from investors. The recent rout in stocks signals an investor exodus is underway, Bank of America strategists wrote in a Thursday note. But downside still looms.

To the analysts, the collapse in speculative tech stocks and crypto rivals declines seen during the dot-com bust and global financial crisis, but that doesn't mean capitulation has arrived.

"Fear & loathing suggest stocks prone to imminent bear market rally but we do not think ultimate lows have been reached, nor ultimate highs in yields," the bank wrote.

Even as analysts see more losses ahead, corporations could save the stock market by returning a big chunk of their $7.1 trillion cash pile to investors in the form of buybacks and dividends, the bank said in a separate note.

"Corporate debt levels are the lowest in decades, leaving ample room to calm nervous shareholders," Bank of America analysts said.

But before that happens, the bank said, stocks aren't going to find a bottom until the market sees "investors selling what they love."

In other news:

2. US stock futures seesawed early on Monday, as traders weighed up data that showed the dramatic impact of the pandemic on China's economy. Meanwhile, wheat prices rose by almost 6% after India imposed a ban on exports. Here are the latest moves.

3. On deck today: Planet Green Holdings, Kingsoft Cloud, and Creative Realities, all reporting. Plus, keep an eye out for John Williams, the president of the Federal Reserve Bank of New York, who is due to make a speech at 8am ET.

4. Bank of America and UBS strategists broke down whether Wall Street should still hold out hope for a market recovery. Analysts are split on what's next for stocks, as 2022 has seen indexes tumble. Here's four reasons to be hopeful and four reasons to be fearful about the stock market and a potential recovery.

5. Gas prices have surged — but diesel prices have also hit record highs. The sticker price at the pump is noticeable, but a severe supply shortage in diesel holds massive repercussions for the economy and inflation. Here's what you want to know.

6. Crypto billionaire Sam Bankman-Fried says Bitcoin has no future as a payments network. According to the Financial Times, Bankman-Fried said Bitcoin's "proof of work" system won't be able to handle millions of transactions. Here's what else he said.

7. Germany plans to stop importing Russian oil, even if the EU fails to agree sanctions. As per Bloomberg, despite the EU floating a delay to an oil ban, Germany will still push ahead with its national plan to ban Russian oil imports. It comes as Saudi Aramco posted an 82% jump in profits following a surge in oil prices.

8. JPMorgan analysts said the crypto crash isn't a repeat of the 2018 winter yet. They explained why market conditions could still bring "significant upside" despite sagging institutional demand — and they shared which tokens are benefiting from terra's collapse.

9. Famed $18 billion value investing firm Ariel has 7 different funds beating their benchmarks or the broader market. Longtime stock pickers from the company discussed the turn toward value stocks and what they're watching as the market tumbles. Here's what they are buying right now.

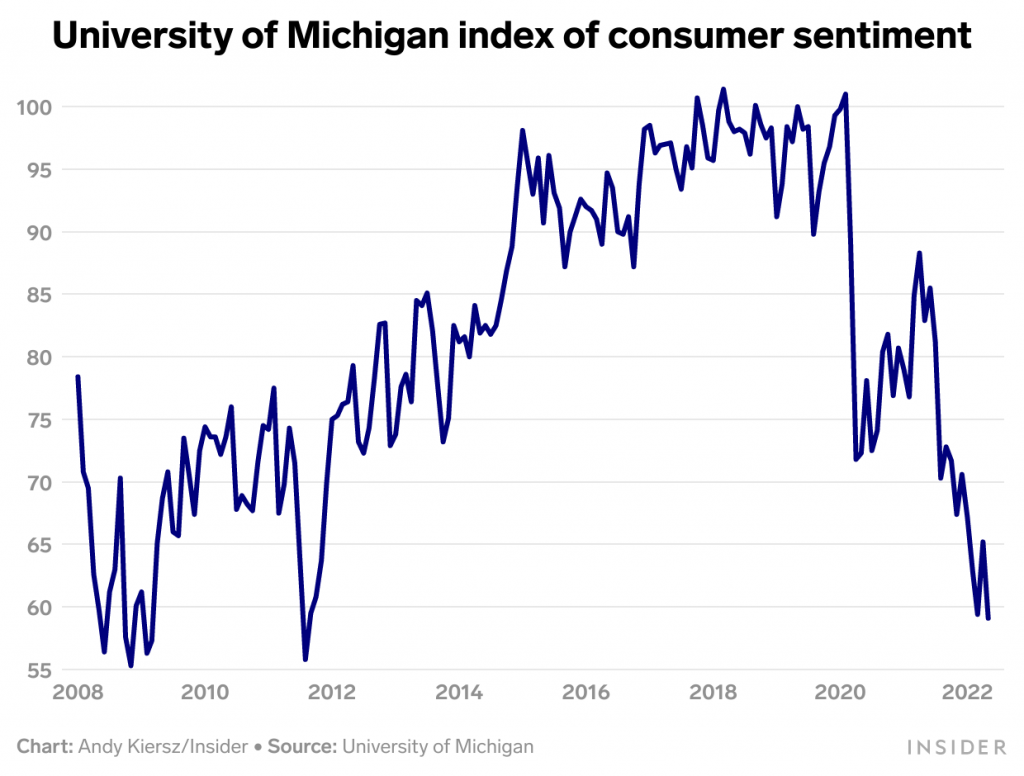

10. Americans' hope for the economy is sinking. A preliminary reading of University of Michigan's index of consumer sentiment on Friday shows that it's reached its lowest point since August 2011 — that's a dip from 65.2 in April.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn.) Edited by Hallam Bullock (tweet @hallam_bullock) in London.